Archive for the 'L & T' Category

High level clearance authority approves investment of 136,000 crores in its 14th meeting

Aluminium, Aluminum ancilaries, Angul, Anugul- Talcher - Saranga- Nalconagar, Business Standard, Coal to diesel, Dhenkanal, High Level Committee, Jindal, L & T, Rayagada, Rayagada- Therubali, Sambalpur, Steel, Sundergarh, Tatas, Textiles, Thermal 1 Comment »Following is from a report in Business Standard.

Orissa government today approved nine new projects, including coal-to-liquid (CTL), steel and aluminium units involving investment of Rs 1,36,000 crore.

The projects got the final nod at a meeting of the high-level clearance authority chaired by Chief Minister Naveen Patnaik, Industries secretary T Ramachandru said.

Apart from two CTL, two steel and one aluminium units, the approved projects included a power plant, one textile unit, a paper plant and an aluminium park, he said.

Among the major proposals was the Rs 42,000 CTL project of Jindal Symflex Ltd to be set up at Durgapur in Angul district using German Lurgi technology, he said adding its capacity would be 80,000 barrels per day.

Requiring 4,000 acre of land, the project would have an 1100 mw captive power plant. Set to provide 6500 direct employment, it would use 90 cusec water from river Mahanadi.

Another CTL project is proposed to be set up by Strategic Energy Technology Systems Pvt Ltd, a joint venture of Tata and Saso, at an investment of Rs 35,000 crore at Gudiakateni in Dhenkanal district.

With a capacity of 80,000 barrels per day, the project requiring 4,000 acre land would have 1100 mw generation facility. It would generate 6700 direct employment while drawing 90 cusec water from river Mahanadi.

An aluminium project is proposed to be set up by a joint venture of L&T and Dubal at an investment of Rs 30,000 crore over an area of 4000 acre in Rayagada district. Its refinery would have 3 mtpa capacity and smelter 1.5 mtpa. It would draw 60 cusec water from river Nagavali.

Seeking to further raise energy production, the HLCA cleared a proposal of Lanco Dabandh Power Ltd to have another 1320 mw unit at an investment of Rs 5000 crore in addition to its earlier plant of same capacity in Dhenkanal district.

In textile sector, Andhra Pradesh based NSL Textiles Ltd would set up an integrated textile plant at an investment of Rs 1500 crore with a promise to provide 5000 jobs and steps to encourage one lakh farmers to grow cotton over an area of 2.25 lakh hectares of land.

Following are excerpts from a report in Pioneer.

With this, the total investments in the State’s industry sector went up to `5.36 lakh crore.

… Principal Secretary of Industries, T Ramachandru said the two ambitious coal-to-liquid projects are first of its kind in the country to be set up in joint venture. While Jindal Synfuels Limited of Jindal Steel and Power would set up a `.42,000-crore plant with technical collaboration of Largy of Germany, Strategic Energy Technology, a Tata venture, would establish its project with an investment of `45,000 crore with technological collaboration of Sasol of South Africa.

He said Jindal;s plant would be located at Durgapur in Angul district with a production capacity of 80,000 barrels of diesel and other petroleum products per day. Besides, Jindal Synfuels would also establish a 1100-MW captive thermal power plant. The project would require 90 cusecs of water to be drawn from the Mahanadi. It would require about 4000 acres of land. It would provide employment to around 6,500 persons.

The Tatas would set up their project in Dhenkanal district in 4,000 acres of land with a requirement of 90 cusecs of water. The project, which includes a 1,100-MW captive power plant, has direct employment potential of 6,400 persons and would produce 80,000 barrels of petroleum products per day, Ramachandru said.

He said both the projects have already been allotted with coal blocks by the Central Government.

Aditya Aluminium would establish an aluminium park at Katarbaga near Rengali in Sambalpur district by investing `1,300 crore to encourage ancillary and downstream industries in the small-scale sector. The park, which would require 211 acres of land, would facilitate units like foundry, wire drawing, extrusion and coil in its cluster.

The HLCA also approved the proposal of L&T Dubal, a joint venture company of L&T and Dubal Aluminium of Dubai, to establish an integrated aluminium project with a 3-MTPA alumina refinery and a 1.5-MTPA smelter with an investment proposal of `30,000 crore. The aluminium project would be located at Rayagada. The project, whichwould provide direct employment to 3,000 persons, would require 4,000 acres of land and 60 cusecs of water to be drawn from Nagavali river. The company is already in possession of bauxite mines.

Andhra Pradesh-based NSL Textile has also received clearance of its proposal to set up an integrated textile project at Rayagada with 3-lakh spindle capacity. The company would invest `1,500 crore to produce 6,000 pieces of cloths of varied qualities per day, Ramachandru said. He said the company would enter into agreements with farmers for cultivation of cottons to meet its raw material demands. The company would involve at least one lakh cotton growers for cultivation of cotton in 2.5 lakh acres of land in a buyback process. It would instal ginning, cotton processing, yarn preparation and finished clothes plants. It requires 400 acres of land Besides these new projects, the Industries Secretary said, the HLCA cleared the proposal of JK Paper Ltd of Rayagada to expand its capacity to 1.5 lakh tonne per annum with an involvement of `1,475 crore. With the capacity addition, the company would provide employment to 3,800 more persons. The company has applied for 150 acres of land to its existing 659 acres to set up the expansion project.

The HLCA also accorded approval to Adhunik Metalics to expand its steelmaking capacity to 3.2 MTPA in its Kuanramunda project in Sundargarah district. The company, which proposes an additional investment of `8,125 crore, promises to provide 2,100 more jobs. Presently, its production capacity is around .041 MTPA. It requires 100 acres of land for the expansion project.

OCL Iron and Steel Ltd got the clearance for capacity addition to its project at Kutnia, Rajgangpur to 0.95 MTPA at an investment of `2,834 crore. It proposes to provide 2,500 more direct jobs. It also envisages downstream industries and requires 650 acres land.

The HLCA also approved the proposal of existing Lacno Babandh Power Private Ltd at Khadakhprasad to double its power generation capacity from 1,320 MW.

It proposes to set up two new units of 660 MW and invest additional `5,000 crore in its thermal power plant. It requires an additional 700 acres of land and would provide employment to 800 more persons, the Industries Secretary said.

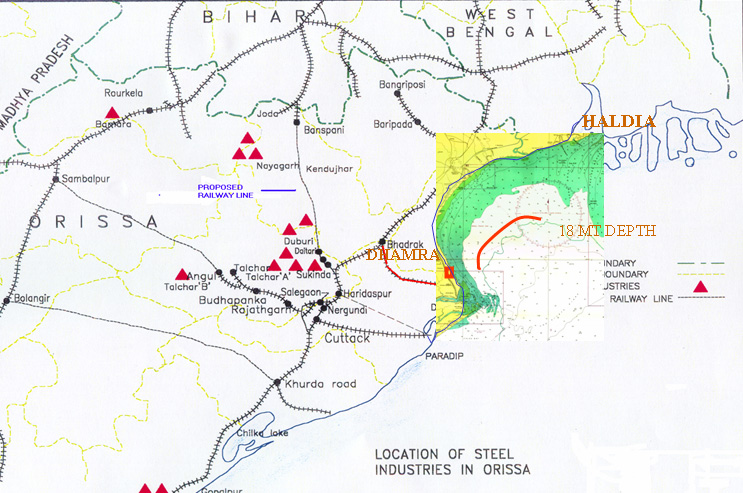

Dhamara port all set to start operations in April 2011; builds sister port relationship with Seattle port

Bhadrakh, Dhamara port (under constr.), L & T, Tatas Comments Off on Dhamara port all set to start operations in April 2011; builds sister port relationship with Seattle portFollowing is an excerpt from a report in Economic Times.

The Rs 3,200-crore Dhamra Port in Orissa, a 50:50 joint venture between Tata Steel and Larsen & Toubro (L&T), is ready and will go operational next month, a top company official said.

Dhamra Port Company Limited (DPCL) has so far invested Rs 2,900-crore out of the total project cost of Rs 3,239-crore and almost 100 per cent work on the project has been completed.

… "We have completed 100 per cent work of the port including the construction work for the 62-kilometer rail link from Dhamra to Bhadrak on the main Howrah-Chennai line," he said.

… Situated between Haldia and Paradip, the port at Dhamra will be the deepest of India with a draught of 18 meters, which can accommodate super cape-size vessels up to 1,80,000 dead weight tonnes (DWT).

DPCL has recently entered into a sister port relationship agreement with the US-based Port of Seattle. The pact is aimed at exchange of information on port users, technology transfer and sharing of best practises between the two ports.

Following is a map from http://www.dhamraport.com/maps.asp.

Projects worth Rs 35,000 crores approved in power and steel sector

High Level Committee, Jindal, L & T, Odisha govt. action, Steel, Thermal Comments Off on Projects worth Rs 35,000 crores approved in power and steel sectorFollowing is excerpted from a report in Indopia.

The Orissa government today formally approved investment of about Rs 35,000 crore in the power and steel sectors of the state. The high-level clearance authority (HLCA) chaired by Orissa Chief Minister Naveen Patnaik gave green signals for the investment in five power projects and one steel unit.

… The HLCA approved investment in five proposals in the power sector and one steel project, Garg said adding that altogether the projects would provide direct employment to over 6,000 people.

The projects, which got HLCA nod were – Visaka Thermal Power Limited (1100 MW), Sahara India Private Limited (1,320 MW), L&T (1,680 MW), JSPL (1,320 MW) and Ind-Bharat Limited (700 MW).

The HLCA approved JSPL&aposs another proposal of further investment in its proposed 6mtpa steel mill at Bainda.

JSPL, which had earlier proposed to invest Rs 13,135 crore in its steel project could now invest Rs 22,420 crore.

Single window clearance for L&T’s power project in Dhamara and JSPL’s power project in Dhenkanal district

Bhadrakh, Business Standard, Dhamara- Chandbali- Bhitarakanika, Dhenkanal, Jindal, L & T, Single Window Clearance (SLSWCA), Thermal 1 Comment »Following is from a report in Business Standard.

The State Level Single Window Clearance Authority (SLSWCA) headed by Orissa chief secretary Ajit Kumar Tripathy today approved 2 thermal power projects with combined investment of Rs 16,140 crore.

This includes 1680 Mw thermal power project proposed by L &T with an investment of Rs 10,200 crore near Dhamra in Bhadrakh district and 1000Mw thermal power plant proposed by Jindal Steel and Power Ltd (JSPL) at Bainda in the Dhenkanal district with an investment of Rs 5940 crore.

SLSWCA, which considered 10 proposals in the power and steel sector today approved 2 proposals, rejected two proposals while deferring its decision on the remaining 6 proposals.

The two proposals which were rejected are Surya Chakra Power Company proposing to set up a thermal power plant at Balasore and Adhunik power proposing a thermal power plant at Banto in Bhadrakh district.

Talking to the media after the meeting, A K Meena, managing director, Industrial Promotion and Investment Corporation Ltd.(Ipicol) said, due to the non availability of water in different locations some proposals have either been rejected or deferred.

He said, SLSWCA approved the proposal of the L&T Ltd. subject to the condition that the company will use sea water for its plant. Besides, it will have to withdraw the case filed against Orissa government regarding the iron ore lease. It has been suggested that the company will be allowed to sign the memorandum of understanding (MoU) with the state government only after it meets the above two conditions. Similarly, SLSWCA recommended the proposal of the JSPL for setting up a thermal power plant subject to the participation of the company in the creation of water storage capacity in river Mahanadi. The proposals which were deferred are those of Tuff Energy, Tata Sponge Iron Ltd., JR Power Gen Ltd., Poysa Power Project Ltd., Jindal India Thermal Power (capacity expansion) and Lanco group (capacity expansion).

L & T receives order of 1372 crores for three plants in Orissa

Aluminium, Angul, Anil Agarwal, Anugul- Talcher - Saranga- Nalconagar, Birlas, Kalahandi, L & T, Steel, Vedanta 1 Comment »Following is from a report in Economic Times.

MUMBAI: Larsen & Toubro shares edged higher Tuesday after it won orders worth Rs 1372 crore from aluminium and steel makers.

The orders were received from Vedanta Aluminium, a part of Vedanta group, Utkal Alumina International and Bhushan Steel, it said in a statement.

The Rs 516 crore order from Vedanta Aluminum was for setting up of a 3 million tonne per annum alumina refinery at its Lanjigarh plant in Orissa. Utkal Alumina’s order was worth Rs 455 crore in which the engineering and construction firm would set up a 1.5 MTPA green field alumina refinery at Doraduga in Orissa.

Furthermore, L&T has secured an order worth Rs 401 crore from Bhushan Steel for civil, structural, equipment, erecting and piping works at Angul in Orissa.

Golden future of Dhamara

Bhadrakh, Bhadrakh - Dhamara (port conn. planned), Bhadrakh-Dhamara, Bhitarakanika, Dhamara port (under constr.), Dhamara- Chandbali- Bhitarakanika, L & T, Shipyard, Tatas Comments Off on Golden future of DhamaraDharitri has a nice article on the golden future of Dhamara. Following are some of the major projects involving Dhamara. My prediction is that in 10-15 years the Chandbali-Dhamara-Bhitarakanika area will be a beautiful metropolitan area next to a national park. (See top right in this map.)

- L & T and the Tatas are building a port in Dhamara.

- Central government is upgrading Dhamara fishing jetty to an international fishing harbor.

- Bharati Shipyard and Appejay group plan to build a shipyard in Dhamara.

- A railway line connecting Dhamara and Bhadrakh will be build.

- Good roads will definitely connect Dhamara to nearby National Highways.

- Dhamara will be a major stop in National Waterway 5.

- Dhamara is next to the Bhitarakanika National Park (more)

Bhushan’s Rs 1250 crore order from L&T-Paul Wurth consortium

Dhenkanal, Iron Ore, L & T, Steel Comments Off on Bhushan’s Rs 1250 crore order from L&T-Paul Wurth consortiumFollowing are excerpts from a report in domain-B.

The Larsen & Toubro Ltd (ECC division) consortium with Italy’s Paul Wurth has been awarded a Rs1,205-crore turnkey construction contract for Bhushan Steel’s 2.5 million TPA blast furnace at its Meramandali plant in Orissa. …

L&T’s share in this project is pegged at Rs760.5 crore from this order, scheduled for completion in April 2010.

Paul Wurth’s scope covers basic engineering, supply of proprietary and special equipment and technical supervisory services while L&T’s scope covers detail engineering, supply of indigenous mechanical, electrical and instrumentation works including complete site services involving civil structural and erection works.

The project is the consortium’s third successive order for the construction of large capacity blast furnaces in the last two years, which is presently executing the 2.5 million TPA (MTPA) blast furnace on turnkey basis for Tata Steel at Jamshedpur, currently nearing completion.

Recently, the consortium bagged another order from Tata Steel for the 3.2 MTPA blast furnace at its Kalinganagar Project. In addition, it also commenced work on the 2.5 MTPA blast furnace for the public sector Rashtriya Ispat Nigam Ltd, Vishakapatnam.

L&T to invest around Rs 400 cr in alumina joint venture in Orissa

Aluminium, INDUSTRY and INFRASTRUCTURE, L & T, Rayagada Comments Off on L&T to invest around Rs 400 cr in alumina joint venture in OrissaEconomic Times reported that

Larsen & Toubro, the country’s biggest engineering firm, will invest around Rs 400 crore in its proposed three million tonne alumina refinery joint venture with Dubai Aluminium Company (Dubal) in Orissa. It further said that "The total project cost would be Rs 15,000 crore. L&T would do the engineering, procurement and construction job for the project, which would cost around Rs 5,000 crore. The first phase of the plant at Rayagada with 1.5 million tons capacity is scheduled to be operational by 2010. In another similar report Zee News reported that Dubal will have the majority 74 per cent stake in the venture and the remaining 26 per cent will be with L&T.

L & T consortium receives orders from Tata Steel for the later’s Kalinga Nagar plant

Jajpur, Jajpur Rd- Vyasanagar- Duburi- Kalinganagar, L & T, Steel, Tatas Comments Off on L & T consortium receives orders from Tata Steel for the later’s Kalinga Nagar plantMyiris and others report on this. Following is an excerpt.

Larsen & Toubro (L&T) announced on Monday that the company led consortium bagged orders worth Rs 10.70 billion for supply & installation of Sinter plant and other packages from Tata Steel.

Tata Steel is setting up an integrated steel plant with capacity of 6 million tons per annum (MTPA) in Kalinganagar industrial complex at Duburi in Jajpur district of Orissa to be completed in two phases of 3 MTPA each. The orders are for the first phase of this greenfield project.

Sinter Plant

L&T in consortium with Outotec, Germany bagged EPC (engineering – procurement – construction) contract for 5.75 MTPA Sinter plant valued at Rs 8.36 billion. The company`s share of this order is Rs 6.23 billion. This would be the single largest Sinter plant to be built in India. This is scheduled for completion in 30 months.

Steel Melt Shop

L&T has also been awarded the contract for civil and structural steel works of steel melt shop valued at Rs 2.33 billion. This is scheduled for completion in 28 months.

From natural resources to human resources – a first formalized step?

HRD-n-EDUCATION (details at orissalinks.com), INDUSTRY and INFRASTRUCTURE, L & T, Rayagada, Rayagada- Therubali Comments Off on From natural resources to human resources – a first formalized step?Today’s Business Standard reports that all future MOUs signed by the Orissa government will have more conditions related to value addition, employment infrastructure and ancillary development. Following are some excerpts from that article.

The Orissa government has decided to incorporate new conditions in all MoUs to be signed henceforth with investors proposing to set up projects in the state, to compel them deliver more on value addition, employment, infrastructure and ancillary development front.

At a meeting today, L&T officials made a presentation regarding plans on investment in Orissa and the benefits to flow to the state. According to sources, the company has agreed to upgrade the existing plant of L&T plant located at Kanspal near Rourkela in Sundergarh districts where high end engineering products will be manufactured.

Similarly, it has been asked to set up a technical institution closer to the refinery site and develop a greenfield plant. The company will also be involved in the infrastructure development.For this, the company has been asked to participate in the Special Purpose Vehicle (SPV) for Therubali-Gunupur Rail Link. Further, in order to promote employment in the state the company will be asked to develop downstream industries, he added. It may be noted, the details of the MOU conditions will be worked out within next 2-3

days before formal signing of the MOU.

…

This changed attitude of the government to extract certain commitments from the industry in MoUs to safeguard the state’s interest is likely to be reflected in the signing of the Memorandum of Understanding (MOU) for the L&T-Dubal project, a joint venture between L & T of India and Dubal Aluminium of Dubai.

This is a good first step; especially the part regarding establishment of “technical institute.” However, it is not clear what kind of technical institute is referred to: an ITI, a polytechnic, or a degree engineering college. The government should insist on all three. As a reference point Jharkhand has convinced Central Coalfields to set up an engineering college in Jharkhand, and Bokaro Steel Plant to set up an engineering college and a medical college in Jharkhand.

Orissa must follow Jharkhand’s example. It should not only require a medical college and an engineering institution (with degree college, polytechnic and many ITIs as part of it) from the new companies but also require it from existing companies; both public and private ones. The existing companies which do not agree to this should be blacklisted and not given any preferred treatment for various things such as permissions, renewals, expansions etc. To discourage them from delaying, an escalation formula should be worked out so that the more the company delays the more it has to put in later.

Collection of old links on investments and investment plans

Anil Ambani group, Arcelor Mittal, Birlas, Central public sector, CIL, Indian majors, Industrial houses, INVESTMENTS and INVESTMENT PLANS, IOC, L & T, MCL, Mukesh Ambani group, NALCO, NTPC, POSCO, SAIL, Tatas, Vedanta Comments Off on Collection of old links on investments and investment plansFollowing is somewhat of a dated collection on investments and investment plans in Orissa.

- Summary: [1], [2], [3:Interview with CM]

- New jobs: [1.5 lakhs new jobs]

- Directorate of Industries, Govt. of Orissa

- Education and Education related financing

- Loans and insurance for college education:

- Higher Education: [FinExp-Aug05]

- Primary and Secondary Education: [Insurance-plan-Aug15-05], [Insurance-plan]

Editor’s comment, Aug 14, 2005: The private engineering colleges and medical colleges should be encouraged to open one or more Class I-XII schools. In general, these private colleges should spend 10% on the above, 80% on their own stuff, and another 10% on post-graduate education. For the 10% parts they can either have their own ClassI-XII school and M.Tech/Phd Program or pay the amount to an appropriate fund.

Editor’s comment, Aug 14, 2005: For Oriya medium students to compete well in national and international level exams and competitions, after class 7 one should have the option of pursuing science and social science either in English or Oriya. To overcome the worry that students will lose touch with Oriya by pursuing science and social science in English, from Class 7, Oriya should be split to two parts, and be assigned twice its current weightage. I.e., instead of 100 marks for Oriya, there will be 200 marks for Oriya. The two parts could be (i) grammar and vocabulary — similar to TOEFL and GRE, and (ii) Writing and literature. ( Some decisions related to this made by the Orissa government.)

- Information Technology: [TCS1], [TCS-2], [TCS-3], [Wipro-BPO-1], [WIPRO-2], [Wipro-land-bought], [other IT and BPO companies]

- Steel plants: Tatas, KK Birla Group, Jindals, Essar, Murugappas, MESCO, POSCO etc. [1], [2], [3], [4], [5], [6:Jindal], [7:mesco-insightOrissa-july22-05], [8: A summary article in May 05 Orissa Review], [Adhunik-Sundergarh], [Rungta,Bhusand,Jindal-JSPL,Titanium], [production in 9 plants], [More MOUs], [More MOUs2]

- Tatas – Steel plant@Duburi, TCS@BBSR, Gopalpur: [0: TATA news releases], [1], [2], [3], [4], [5], [6:Kalinganagar],

- POSCO: [1], [2], [3], [4]; [Forbes-MOU-22Jul05]; [Forbes-2-22Jul05]; [FinExp-MOU-22Ijul05]; [HindTimes-MOU-22Jul05]; [AustrFinRev-MOU-22Jul05]; [InsightOrissa-MOU-22Jul05]; [Some-Details-from-Insight-Orissa]; [Pluses-n-minuses:rediff]; [Impact-on-infr]; [Hindu-July10-05]; [Rebuttal-to-criticisms-july15-ToI]; [FinExpr]; [Taats vs POSCO] ; [3 POSCO subunits]; [POSCO sets up subsidiary:Aug 31’05], [land-acq], [90 percent in Orissa in favour], [identifies 2 mines]

- POSCO ancillaries and Indian partners: [1:steel pipes], [2:Indian partners]

- Editor’s comment on July 4 2005: My impession based on reading the newspapers is that Orissa govt has probably become wary of some of the big Indian players after the TATAs taking advantage of them in Gopalpur, and other companies in other places. It seems like (from reading various reports: [0:a list from 1999-how many of them materialized?], [1] , [2], [see page 3], [4] ) the TATAs signed MOUs about plants and infrastructure etc. at Gopalpur and got mining leases but then kind of forgot about making the plants and building infrastructure but have been using the mines. They used excuses, some valid, regarding this and that infrastructure not being there. [They have signed something more recently; lets see if that is for real or a sham to get mining leases renewed. Some progress in regards to their promise seems to have taken place: a; b ] The expectation was that Gopalpur would be like another Rourkela or Jamshedpur. But nothing remotely like that has happened. Coming back to POSCO, the MOU seem to have many clauses that would prevent POSCO from taking advantage of Orissa without delivering on its promises. Also, if POSCO does something like the TATAS, its easy to fight them, unlike fighting the TATAs. Even saying something bad about the TATAs is a no-no in India. [Thus the government should be careful in any of its signing with the TATAs or similar big Indian powerhouses. It should make sure that any mining lease should be tied to the other promises very tightly, and without loopholes.] So I personally am hopeful that POSCO will have a big impact on Paradeep and Orissa, more than the impact of any other private company in Orissa. Plus the investment comes from outside India, not from inside India. Thus making more capital available to other projects in India. Also the government is right to not put its egg in one basket. It makes perfect sense to try different avenues: foreign investors such as POSCO as well as the various Indian companies.

- From Steel to automobiles/2-wheelers-n-beyond: [Ind-Exp-22ndJune05]; [TOI-July4-05:Kymco,Corus]; [Pioneer-July27-05:Kwang-Yang-Motors-Taiwan], [Mahindras:TOI-Aug05-05], [Mahindra:InsightOrissa]

- Refractories: [July9-05-Telegraph]

- Alumina/Aluminium: Hindalco [1]; Vedanta [a], [b:Vedanta cares]; [Dubal-L&T]; [alumina-refinery-smelter-Rayagada]

- Titanium complex at Chhatrapur. (The Samaja Aug 16th, 2005).

- Mining: [1],

- Refinery: [1]; [IOC-Paradeep-21-6-05]; [July12-FinExp], [IOC-on-schedule]

- Breweries: [United Breweries]

- Paper: [JKPaper]

- SEZs: [1]

- Gopalpur: [july26-05]

- Paradeep: [july26-05]

- Power: Current availability; [list-of-possibilities-fe-july24-05], [June2-05-Reliance]; [Reliance2]; [RPG-jun2405-Tel]; [Neyveli]; [MMTC-Paradeep-Sept12-05]

- Food processing: [Shrimp-Navayuga]

- Hospitals: [Planned Heart Institute]

- Hotels: [ Statesman Aug 18’05], [Buisness-Standard- Sept9], [OTDC-disvestment]

- In relation to other states of India: [1], [2]

- Kalinganagar/Duburi: VISA, Jindal, Neelachal Ispat Nigam, MESCO, Tatas(?) [Ref:InsightOrissa]

- Factories in neighbouring states — impact on Orissa infrastructure: [Mittal-Jharkhand]

Editor’s comment on July 27, 2005: Jharkhand and Chhatisgarh are landlocked. Mineral and manufacturing plants in Jharkhand and Chhatisgarh would need access to ports. This will provide opportunity for Orissa to make its case (get Jharkhand and Chhatisgarh legislator’s support) and make further infrastructure development such as ports, roads and railways. In particular, Dhamara and Chandabali port, train lines to them such as Tata-Baripada-Balasore-Dhamara, Bimlagarh-Talcher-Paradeep, and Daitari-Bansapani-Haridaspur-Paradeep, and roads ( Jharkhand, Orissa, Chhatisgarh) to them. While Jharkhand plants can use Haldia port in West Bengal, for Chhatisgarh the closest ports are in Orissa (Dhamara, Paradeep, and Gopalpur). Since Haldia port is overloaded, even for Jharkhand easy accessibility to Orissa ports is important. [a step in this regard], [another step]

28th July 2005: Orissa, Jharkhand and Chhatisgarh should come together and jointly pursue several things. For example, an IIT in Rourkela (which has the best NIT among the three states) would benefit all the three states, as Rourkela is very close to both Chhatisgarh and Jharkhand. In return Orissa can support for an IIM in Bilaspur or Raipur. Good road and railway connectivity from Chhatisgarh and Jharkhand to Orissa ports will be beneficial to all. The three states can jointly promote cultural tourism to the tribal areas of the three states. - Policies: [1]